How To Protect Seniors From Financial Abuse and Fraud

In the U.S., elder financial abuse leads to an estimated $28.3 billion in annual losses. In Las Vegas, where a large senior population resides, vigilance is critical. Scammers often target older adults with tech support, investment, or romance scams. Legal professionals and family awareness can help prevent financial exploitation and protect vulnerable seniors from lasting harm.

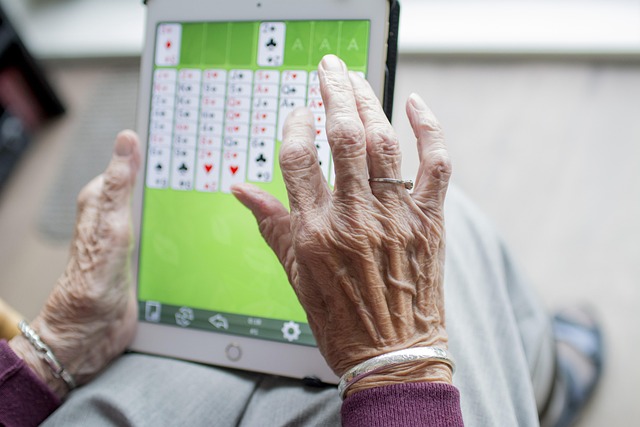

Every year, thousands of seniors become victims of financial abuse and fraud, causing incalculable emotional and financial pain. As the aging population increases, the need to protect seniors from financial abuse is more important than ever. In this article, we will look at some strategies and steps we can take to keep seniors protected from financial harm so that they can enjoy their golden years with serenity and safety.

What Is Financial Abuse and Fraud?

Financial abuse is the misuse of a senior’s resources or taking advantage of a senior for someone else’s gain. This can be through things like taking money from them, pressuring them into financial choices, or abusing the power of attorney, unlike fraud, where the fraudsters use various tactics to dupe the seniors to part with their assets. Well-known scams include phone calls, emails, and even visits to the house aimed at our older citizens.

Recognizing Warning Signs

Recognizing the possibility of abuse early can prevent future damage. You can look out for triggers such as mysterious amounts of money disappearing from either joint or personal accounts or sudden changes to spending, savings, or belongings, any of which signal the potential for financial abuse. Concealment of finances is a common trait of anxiety and an indication of possible financial abuse by a family member, especially if the senior suddenly becomes tight-lipped about their money.

Working With Seniors and Caregivers

Education is an essential safeguard against financial abuse. Elderly people and their caregivers should be able to identify and avoid common scams. One other answer is to host workshops or seminars to inform the community and to give resources. Families that talk about money are less likely to experience financial abuse. Hence, the plan is to encourage parents and siblings to engage in open discussion and trust about their financial state.

Setting up Financial Protections

Financial Strength: Strong financial protections and measures can help to insulate seniors from threats. To minimize the chances of a thief snatching your checks, you might want to register for direct deposit for payments. The employers will be able to detect any irregular activity at a jump at the bank statement regularly. Seniors should be the ones controlling their spending, and access to online banking should only be available to individual seniors.

Utilizing Legal Tools

Even though legal instruments can provide an extra layer of protection for elderly people, a power of attorney designates a trusted person to conduct financial transactions if the elder becomes unable to do so. However, it is important to find someone who fully honors the senior’s wishes. Having these arrangements reviewed regularly ensures that they continue to serve the senior’s best interests.

Creating a Financial Plan

Financial planning makes for a better lifestyle for seniors and their families due to the peace of mind it affords and mitigates risks. Their plan should detail financial objectives, create a budget, and prepare any required legal documents. If a certified financial planner is in charge of the work, the plan will be able to provide for seniors and protect their assets. Revisiting the plan makes sure it remains up-to-date and works.

Reporting Suspected Abuse

This creates urgency in your next steps when you suspect financial abuse. Informing local law enforcement or adult protective services may trigger an investigation. Informing financial organizations may stop further fraudulent transactions. Community organizations also offer assistance to seniors and their families.

How to Keep Seniors Informed

Knowledge of threats enables seniors to take proper action to avoid becoming victims. Urge them to subscribe to trustworthy newsletters or online sites that specialize in senior safety. Staying updated on the latest scams and fraud trends helps them stay educated and proactive about their hard-earned money.

Legislation and Policies

Stronger legislation and policy can curb the financial abuse of seniors. Advocate for legislation that harshens punishment on perpetrators and streamlines reporting processes. Join the efforts of organizations focusing on elder justice to help build a safer place for the elderly population.

Conclusion

Safeguarding older adults from financial exploitation and fraud is a collaborative endeavor, necessitating the activation of families, communities, and legislators. Without a doubt, we need to understand the risks, mitigate the risks, and create awareness among them to ensure a haven, as we always say — safety first for our elders! None of us would want our elderly friends and family members to be taken advantage of, and we should all stand united in ensuring the safety and well-being of seniors in their later years.